When things seem too good to be true, what should you do as an investor? The answer is to review your emergency plan for when everything hits the fan again just like it did in 2008 and in 2000. Let’s review what the true definition of safety is and how you can make sure that when all of this too-good-to-be-true stuff is done, you’re not holding the bag… AGAIN!

When things seem too good to be true, what should you do as an investor? The answer is to review your emergency plan for when everything hits the fan again just like it did in 2008 and in 2000. Let’s review what the true definition of safety is and how you can make sure that when all of this too-good-to-be-true stuff is done, you’re not holding the bag… AGAIN!

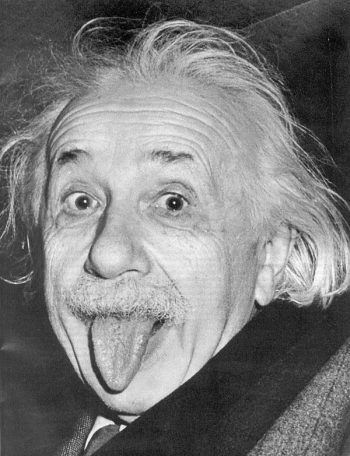

Albert Einstein defined insanity as “doing the same thing over and over again and expecting different results.” Pretty simple. I refer to that quote because

so many investors are doing the same thing today with their money that they were doing before the crash of 2008.

I assume they are expecting different results, which is insane. Maybe their asset allocation is a bit different, and maybe they don’t have as much in the stock market as they did before, but the approach is the same. That approach is what I like to call Blindfolded Pie Chart Investing.

Blindfolded Pie Chart Investing happens when you spread your money all over a pie chart of stocks, bonds, international, and maybe even some real estate and commodities. You then blindfold yourself while hoping that the bedtime story about the investor who stayed in for the long run and rode through the tough times and did really well was true. You’ve heard that one before, right? Some of us know how that story ends: not well.

So be honest with yourself. Am I maybe describing you a little bit? Have you really made any material changes to the way you manage and protect your wealth since 2008? When things crash the next time, will you be protected or will you just begin the very long process of trying to get back to even?

The answer may be to look outside the mainstream of the Wall Street investment machine and look for an approach with the following characteristics:

- Liquidity

- Safety

- A decent rate of return

- Tax free

All I want to leave you with is a simple homework assignment. Think about those four questions and ask yourself if your current investment approach meets those requirements. If the answer is “yes” then contact me to confirm that you’re structured correctly. If the answer is no, reach out to find out about a different approach for your investments when it comes to risk management and wealth building. Contact me.

*****

Information presented in this blog post is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Discussions and answers to questions do not involve the rendering of personalized investment advice, but are limited to the dissemination of general information and may not be suitable for all readers. A professional adviser should be consulted before implementing any of the strategies presented.